The document is ambitious and encouraging in its wide scope, reflecting the commitments of China's leadership. The key elements of this blueprint can be classified as follows:

The first is financial sector liberalization, which includes greater private entry into banking, further interest rate liberalization and opening of the capital account, as well as a more flexible foreign exchange regime. The second is fiscal reform, including anti-corruption and anti-waste campaigns, as well as expansion of the value-added tax pilot program. The third key area is urbanization, with additional public housing construction and more channels for public housing finance. The fourth aspect of reform focuses on the always difficult nexus of the private and public sectors.

|

|

But the real question is whether China can press ahead with these reforms in a lax environment in terms of liquidity or needs to restrain credit to force firms to change. While some reforms may not be influenced by the availability of credit, it is clear that changing the incentive structure in which Chinese companies and banks operate will not be achieved without financial constraints, not to mention reducing overcapacity and improving the environment. This is where the trade-off between growth and reform comes in.

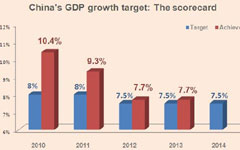

To maintain a bottom line of 7 percent GDP growth this year, the leaders have already fine-tuned the policy stance toward a laxer one, at least in terms of fiscal policy. The government will disburse fiscal money in a more timely manner, continue to build social housing and accelerate public infrastructure investment.

As for monetary policy, interbank rates have been kept at lower levels than in December. Further easing cannot be ruled out, including cuts in the required reserve ratio.

There is room for optimism about medium-term growth in China, especially if the country presses ahead on reform. It is also important to understand that China's growth will decline given its population trends and its rising per-capita income. In any event, growth will be higher with reforms than without. That is what matters.

Alicia Garcia-Herrero is chief economist for emerging markets of BBVA Research, based in Spain. George Xu is an economist. The views do not necessarily reflect those of China Daily.