China's transition from a centrally planned economy to a market one has been neither easy nor linear. The government has tried to liberalize some sectors and privatize some industries, but certainly not all.

One can argue that the dominance of the State-owned sectors has been maintained with a special emphasis since the 2008 global financial crisis. Such a strategic choice is also behind continuing an investment-driven growth model.

But the cost of such a model cannot be underestimated. Resource misallocation, overcapacity in capital-intensive industries, rising domestic financial fragility, as well as many social and environmental problems, are just some of the risks.

|

|

The Chinese economy last year was sustained by exports and supportive government policies, including a mini-stimulus package that focused on infrastructure investment. Economic indicators early this year, however, point to a further slowdown, following sluggish exports and soft domestic demand due to the authorities' tightening measures to curb financial fragility.

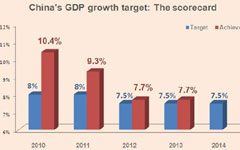

The government announced its GDP growth target at the annual National People's Congress in early March. It remained the same as in 2013, 7.5 percent. But in the face of recent growth headwinds evidenced by gloomy data, Premier Li Keqiang recently hinted that the government will fine-tune economic policies to sustain the economy within a "reasonable zone", which is interpreted as a combination of two limits: an upper limit of 3.5 percent for inflation and a bottom limit of 7 percent for GDP growth. Against a background of moderating GDP growth (7.4 percent year-on-year) and other poor data for the first quarter, maintaining growth above 7 percent means more fiscal and/or monetary stimulus, as Li acknowledged.

The need to push demand policies further and underpin growth above the floor target comes at a time when China really needs to deliver on structural reform. The long-awaited blueprint issued after the Third Plenum in November aims to enhance the quality of economic growth and promote rebalancing of the economy.