|

|

|

|

|||||||||||

|

Wenzhou and Beijing have different thoughts about how much individuals should be allowed to invest overseas, according to Chen Jian, deputy director of the Wenzhou Bureau of Commerce.?[Photo / China Daily] |

Wenzhou official says experiment may be extended to Tianjin and Shanghai

An experiment allowing Wenzhou residents to make investments overseas could be extended to Shanghai and Tianjin, said a city government official.

Chen Jian, deputy director of the Wenzhou Bureau of Commerce, said the central government will "probably" start the experiment at the same time in Wenzhou, Shanghai and Tianjin. A final decision in the matter will be made after central government officials have had time to make more investigations in those cities.

Residents of the Chinese mainland are currently unable to make direct overseas investments. Even so, they can put their money into financial institutions that, in turn, can invest it overseas through the Qualified Domestic Institutional Investor arrangement, which allows banks and fund managers to invest clients' money overseas within set limits.

The new policy is part of a landmark 12-point plan for Wenzhou that the State Council announced on Wednesday. Beyond allowing overseas investments, it also calls for developing privately owned financial services, setting up village banks and rural financial cooperatives and encouraging State-owned banks to lend to smaller businesses.

Chen said Wenzhou and Beijing have different thoughts about how much individuals should be allowed to invest overseas. The city earlier asked that the maximum be set at $200 million a year for each person.

Under the proposal, citizens would also be allowed to take profits that they made and reinvest them overseas. Chen noted that the central government can still modify the proposal.

Chen said investments may also be allowed to go into a wider array of enterprises. In 2011, Wenzhou issued rules that permitted residents to set up, acquire, or invest in non-financial companies in overseas markets but scrapped them two weeks later after Beijing disagreed with the policy.

Last year also saw Shanghai seek permission to test out similar policies. By participating in the current experiment, Shanghai, which is the country's financial center and has a much bigger economy than Wenzhou's, would lend greater weight to it. Analysts also say that would help the country take a small but significant step toward opening its capital account.

Shanghai and Tianjin's financial service offices could not be reached for comment on Thursday.

Dariusz Kowalczyk, an economist with Credit Agricole SA, a French bank, wrote in a research note that the experiment will eventually lead to a full opening of China's capital account. Kowalczyk predicted there would be no big national changes this year, but the test signals the determination of policymakers to continue making reforms.

An opening of capital accounts would help the nation deflate its $3.2 trillion in foreign exchange reserves, which are the largest in the world and were accumulated through its once-rigid system of managing foreign exchange.

If the yuan is to stand as a reserve currency alongside the dollar, euro and yen, it is important that capital accounts be fully convertible. That would give the country a stronger influence on overseas financial markets and cheaper debt financing.

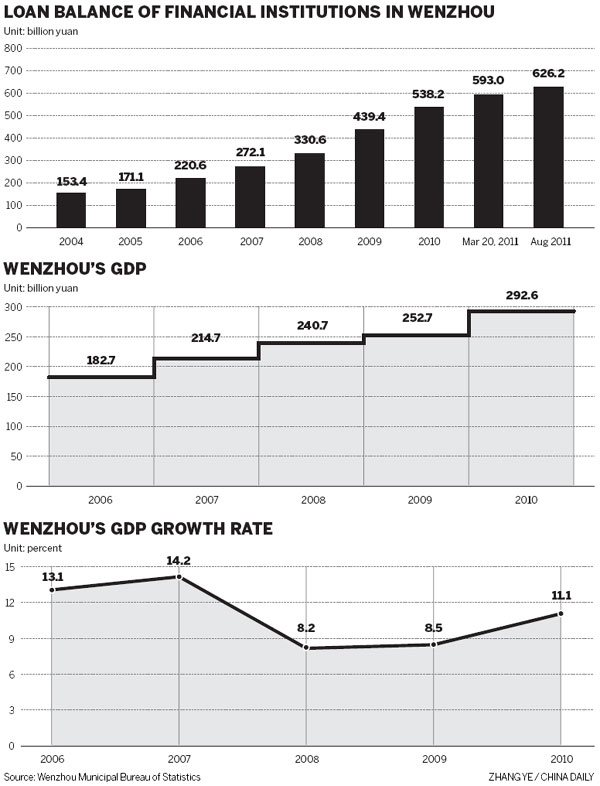

In China, the decision to provide an outlet for Wenzhou's estimated 800 billion yuan in private capital is also expected to help rein in speculation and ease real estate prices.

gaochangxin@chinadaily.com.cn

?

?