Why Chinese firms, media need to tell their story

Third-party commentators filling void, underscoring opportunity for proactive engagement by Chinese buyers

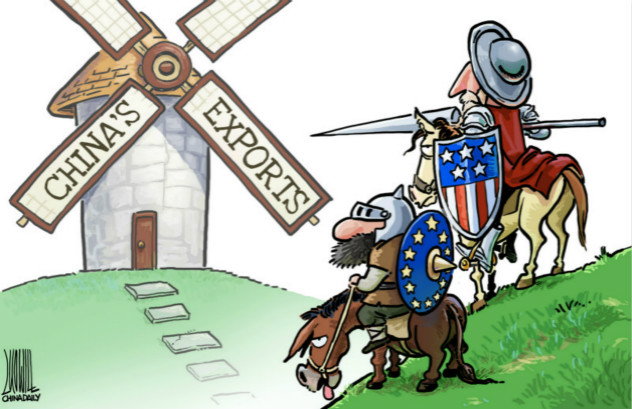

Defying tougher scrutiny and increased protectionist rhetoric across North America, Europe and Australia, 2016 was yet another record year for outbound mergers and acquisitions by Chinese companies. Despite the large numbers of Chinese investors looking beyond their own borders for growth, most of this activity has as yet failed to translate into an improved reputation on the international stage.

While several factors may be at work here, one could be their reluctance to engage with media more proactively. A study conducted by Asia-based strategic consultancy Ryan Communication shows that across several significant transactions in the technology sector between 2014 and 2016, only 28 percent of all quotes in media articles were provided by Chinese buyers. However, taken at face value this number considerably overstates the true extent of Chinese buyers’ representation in international M&A press reports ,since out of these quotes 83 percent came from a single company, Lenovo, during its acquisition of Motorola in 2014.

Moreover, very few companies chose a proactive way of engaging in media activity. Lenovo aside, no other Chinese company in the study engaged directly with the media through on-the-record interviews or email during the acquisition period. Instead, third-party commentators such as sell-side analysts are filling the void, contributing 45 percent of public comment in all news articles.

At a time when China’s authorities are introducing more stringent capital control mechanisms and as new trade barriers are set to rise under the Trump administration, keeping a low profile may prove to be a missed opportunity to improve the environment for Chinese companies abroad.