Curb capital speculation in support of the real economy

|

|

A Chinese worker processes steel at a factory in Qingdao city, East China's Shandong province, July 1, 2016. [Photo/IC] |

Among all the key takeaways of the recent Central Economic Work Conference, two priorities draw special attention.

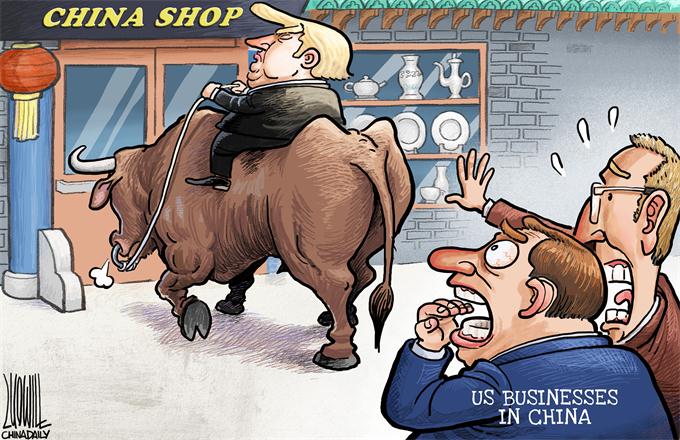

One priority is the promotion of the stable and healthy development of the property market. The conference emphasized the urgency of curbing property market bubbles and speculation. One of the highlights in the Chinese economy over 2016 was the rampant rise of property market prices, starting in Beijing, Shanghai and Shenzhen, and then quickly expanding to a number of the second tier cities, namely Nanjing, Suzhou, Hangzhou, Hefei, Xiamen and Wuhan. It only quieted down somewhat after exceptionally stringent measures announced in late September across dozens of cities.

According to the People’s Bank of China (PBOC) official data, outstanding long term consumer loans, mostly home mortgage loans, were 19.36 trillion yuan at the end of November, 2016, 29.1% up over that at the end of January, or a net increase of 4.37 trillion yuan. Forty-eight percent of the total net increase of total bank loans (9.10 trillion yuan), although its total volume accounts for 17.5% of the latter. The fundamental factor behind the sharp property market rises is speculation, buying a house only to sell it later, making considerable profit in a fast-rising market. Hence, houses are no longer living quarters but a financial tool, only for the increase in their face value. The capital, in chasing profits, chases the house deals. Local governments, hungry for money, play a key role in pushing up land prices. In turn, the banks tend to extend mortgage loans to home buyers, not caring whether they are speculators, because they have houses as mortgages.

The first consequence is that any further rises in the property markets will lead to a higher debt ratio, and a significant property price fall will definitely lead to a chain of disclosures and bank insolvency risks, and in turn, lead to a systemic financial risk in the country. In that event, the financial crisis will be not far away.

The second consequence is dampening the real economy. Property market speculation and bubbles are sucking financial resources at the cost of the real economy. During the first 11 months of 2016, outstanding bank loans to the non-financial business and institutions increased by a merger 4.5%, or a net increase of 3.14 trillion yuan. Its share in total outstanding bank loans fell from 70.0% to 65.2%. Property market speculation usually has a much higher capital return than the real economy, especially manufacturing. TCL, a leading manufacturing giant, also relies on real estate development for a better overall performance. Haier, the world leader of white home appliances, also has huge land plots for real estate development in Qingdao, Jinan, Chongqing and Suzhou.