ABC plans sale of bad assets

Nonperforming loan ratio rises among top 10 listed lenders

The nation's third-largest lender, Agricultural Bank of China Ltd, will sell nonperforming assets valued at 10 billion yuan ($1.6 billion), the bank said on a briefing on Thursday.

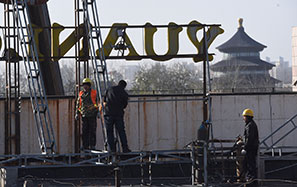

ABC is to sell 19 properties used as collateral, along with seven loans, on the Beijing Financial Assets Exchange, the lender said.

Analysts said that more Chinese lenders may sell nonperforming assets as banks face pressure from souring debts amid an economic slowdown.

|

An Agricultural Bank of China Ltd outlet in Nanjing. ABC had the highest NPL ratio among the nation's 17 publicly traded lenders, according to first-half earnings reports on the China Banking Regulatory Commission's website. Provided to China Daily |

According to statistics from PricewaterhouseCoopers China, outstanding delinquent loans held by the top 10 listed banks stood at 585.8 billion yuan at the end of June, up 20.42 percent from the end of 2012.

The delinquent loan ratio rose from 1.21 percent at the end of 2012 to 1.35 percent at the end of June. The increase signals a possible later rise in NPLs.

The top 10 listed banks are ABC as well as Industrial and Commercial Bank of China, China Construction Bank Corp, Bank of China Ltd, Bank of Communications Co Ltd, China Merchants Bank Co Ltd, Industrial Bank Corp Ltd, China Minsheng Banking Corp Ltd, Shanghai Pudong Development Bank and China Citic Bank International Ltd.

ICBC (the world's most profitable lender), CCB, ABC, BoC and BoComm are the five largest lenders in China. They wrote off 22.1 billion yuan of debt that couldn't be collected as of the end of June, 7.65 billion yuan more than in 2012, according to their exchange filings.

ABC had the highest NPL ratio among the nation's 17 publicly traded lenders, according to first-half earnings reports on the China Banking Regulatory Commission's website.

"NPLs are under pressure as economic growth slows, but high levels of loan loss reserves may provide a cushion," wrote Christine Kuo, vice-president and senior credit officer of the financial institutions group, Asia-Pacific, of Moody's Investors Service in a recent note.

According to lenders' financial statements to the CBRC, as of end-June, the average NPL ratio was less than 1 percent.

The average loan loss reserve was about triple the level of NPLs.

Writing off the worst of their bad debts will allow lenders to mitigate surging NPL ratios amid rising defaults. Regulators have eased rules for debt write-offs to small businesses since 2010, and policymakers have ordered lenders to improve their risk buffers.

In April, the CBRC urged lenders to increase provisions for defaults, write off some bad loans and curb dividend payments while earnings are ample to create a cushion in case of an economic slowdown.

Analysts said that lenders need to improve their risk management skills and pricing capabilities under the increasing pressure of souring debts and contracting profit margins as interest rates are liberalized.

"The liberalization of interest rates demands a higher level of banks' competence in asset and liability management and interest-rate management. Both the current management models and the interest-rate gap management tools need to be re-tailored to cope with the dynamic changes in assets and liabilities, so that banks can effectively manage the interest-rate gap and structural risks," said Jimmy Leung, PwC banking and capital markets leader for China.

"Banks also need to improve their pricing capabilities and optimize their risk management competence, preparing for the final phase of the liberalization in deposit rates," said Leung.

wuyiyao@chinadaily.com.cn