Pressure to mount on Hong Kong dollar

Updated: 2016-01-26 09:22

By Emma Dai in Hong Kong(HK Edition)

|

|||||||||

Strategist cites funds outflow, US rates hikes as negative factors for beleaguered SAR currency

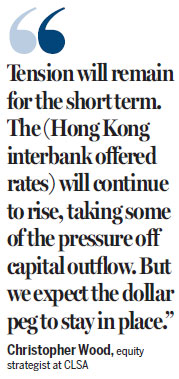

The beleaguered Hong Kong dollar, which hit an eight-year low against the greenback last week, will remain depressed in the near term, given capital flight from the SAR is to continue, with a further US rate hike and speculative attacks on the local currency on the horizon, according to brokerage and investment group CLSA.

Yet, a pause in the US monetary tightening cycle is likely later in the year, said Christopher Wood, an equity strategist at CLSA.

He forecast that capital outflow from Hong Kong will persist due to the interest-rate spread between the SAR and the US.

"Tension will remain for the short term," he said. "The Hibor (Hong Kong Interbank Offered Rates) will continue to rise, taking some of the pressure off capital outflow. But we expect the dollar peg to stay in place."

The overnight Hibor rate stood at 0.03714 percent as the Hong Kong Association of Banks announced at 11:15 am on Monday - down from 0.05457 percent on Jan 18. Three-month and one-year Hibor rates soared during the period from 0.44871 and 0.99179 percent, respectively, to 0.69686 and 1.33114 percent.

However, Wood forecast that "at some point in 2016", the US Federal Reserve (Fed) will review its rate-hike moves and resume monetary easing measures.

The Hong Kong dollar's slump against the US dollar last week fueled speculation that the city's 32-year-old currency peg will be scrapped. But, the Hong Kong Monetary Authority has vowed to defend the local currency and the peg to maintain stability in the local economy.

In the meantime, Wood maintained a "neutral" rating on share prices of Hong Kong-listed mainland companies due to their "low valuation". He rated Hong Kong domestic shares as "underweight", saying that continuous capital flight from the SAR is likely to hit them harder, as sentiment is expected to stay "weak" amid turmoil in the mainland equity markets.

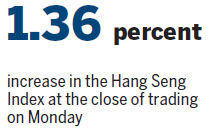

The benchmark Hang Seng Index rose 1.36 percent, or 259.63 points, to close at 19,340.14 on Monday, while the Hang Seng China Enterprises Index edged up 0.84 percent to 8,173.11. Sentiment was boosted by hopes of stimulus measures in Europe and Japan, as well as a rebound in oil prices.

On the property sector, Wood predicted that Hong Kong's property market has a 10-percent downside risk this year amid Sino-US monetary policy divergence, but stressed that the sector will not collapse as various policy easing measures remain in the hands of the SAR government.

The key for the mainland to watch this year is its domestic inter-bank rate as the pressure of capital flight is mounting in the country while speculators are betting on renminbi devaluation. But, as long as the country manages to enforce capital account control rules, renminbi will stabilize against a trade-weighted basket of currencies as the People's Bank of China desires to achieve, Wood said.

"Then, speculators will turn to attack the Hong Kong dollar which will then present good opportunities to buy Hong Kong-listed blue chips."

emmadai@chinadailyhk.com

|

An enlargement of a 1985 Hong Kong 100-dollar banknote is displayed during an exhibition at HSBC headquarters in Central. The Hong Kong dollar fell to more than eight-year low last Wednesday as the mainland's sluggish economy and weak yuan currency dampened the market sentiment. Bobby Yip / Reuters |

(HK Edition 01/26/2016 page9)