BOC at heart of pivotal strategies for Europe, China

Bank's diversity of services expected to aid Belt and Road Initiative, Juncker Plan

With trade and tourism between China and the European Union at the highest levels in their bilateral history, Bank of China is well positioned to serve both sides as they strive to cultivate new areas of economic growth. Last year, trade between China and the EU exceeded $600 billion. Both China and the EU also have major economic initiatives in the works.

The Belt and Road Initiative, proposed by President Xi Jinping in 2013, is a call for nations in Asia, Europe, the Middle East and Africa to coordinate trade and the construction of infrastructure and promote the renminbi.

The Juncker Plan, proposed by Jean-Claude Juncker, the chairman of the European Commission, last November, aims to drum up 315 billion euros ($356 billion) in public and private investments from 2015 to 2017 to spur the development of infrastructure.

This is where BOC could step in and lend their expertise, its representatives recently told China Daily. As one of the State-owned banks, BOC has unique advantages, including rich experience in international business, a diversity of services and professionalism.

By March, BOC had more than 620 subsidiaries in 42 countries and regions in addition to the Chinese mainland. By the end of last year, its overseas assets totaled $745.1 billion, up 18.1 percent from 2013. These assets generated $8.6 billion in profit, a growth of 29.9 percent from 2013.

BOC owns a suite of innovative services and products to serve the Belt and Road Initiative, ranging from business banking, investment banking, insurance, direct investments, fundraising and aircraft leasing. It also claims to have a global network to make sure its overseas services are as competent as its domestic services.

Professionalism

BOC has dominated the market in the export credit, acquisition finance, trade finance and global cash management sectors because of its professionalism.

As the first Chinese bank that started an export buyer's credit business, it has offered funding support for about 100 projects in over 30 countries, with contracts totaling $8 billion.

It provided loans and consultation services to Chinese grain and cereal company COFCO during its acquisition of Dutch company Nidera Group and to GSR Ventures in its merger with Lumileds Lighting, a subsidiary of Philips.

As the first bank that offered trade-financing services, BOC has supported over 100,000 Chinese "going global" enterprises, which are active in global trade area during their overseas expansion.

In 2014, BOC's cross-border renminbi settlements reached 5.32 trillion yuan ($851 billion), growing 33.7 percent from 2013 to maintain its position as the global market leader. Its cross-border renminbi liquidation business reached 240.8 trillion yuan, up 86.6 percent.

Tian Guoli, BOC's chairman, said the bank had mapped out a number of plans to serve the Belt and Road Initiative since last year, including offering $20 billion of credit this year for projects tied to the initiative and $100 billion over the next three years.

Tian also said BOC will continue to improve its global service network coverage in the coming years and open new subsidiaries in countries that will be served by the Belt and Road Initiative.

He vowed that over half of the countries along the Belt and Road routes will have BOC subsidiaries in three to five years.

The bank is currently planning to open two major subsidiaries in Europe.

BOC has actively supported the Belt and Road Initiative, provides high quality financial services for Chinese enterprises to go global.

By the end of March, the bank supported 1,763 related projects and the commitment balance of the loan reached to $125.8 billion.

Both the Belt and Road Initiative and the Juncker Plan will focus on the construction of infrastructure. BOC is currently supporting the construction of transportation infrastructure, education and research and development, as well as renewable energy sources with loans and credits.

BOC is also an active proponent of the globalization of the renminbi, which is already the seventh-largest payment currency and used for cross-border settlements in 222 countries and regions.

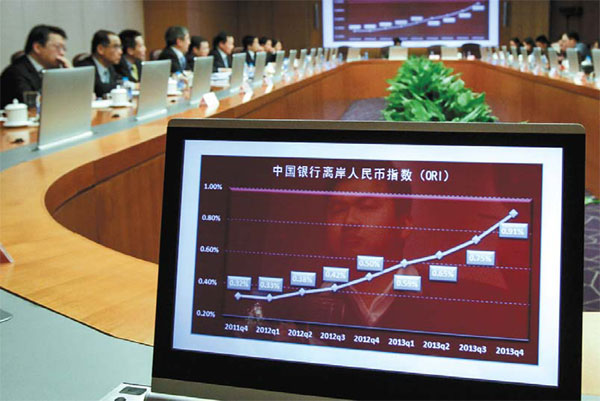

In the fourth quarter of 2014, the Off-shore Renminbi Index of BOC rose to 1.2 percent, which indicated that the renminbi is more and more actively being used in overseas markets.

And BOC will boost the development of offshore renminbi centers in Europe in the coming years.

zhangzhouxiang@chinadaily.com.cn

|

Bank of China's offshore renminbi index rose 1.2 percent in the fourth quarter of last year, an indication that the renminbi is more actively being used in overseas markets. Kuang Linhua / China Daily |

|

Headquartered in Beijing, Bank of China owns a global network that offers a full range of services to international clients. Provided to China Daily |

(China Daily 06/29/2015 page12)