Chinese stocks drop on inflation

|

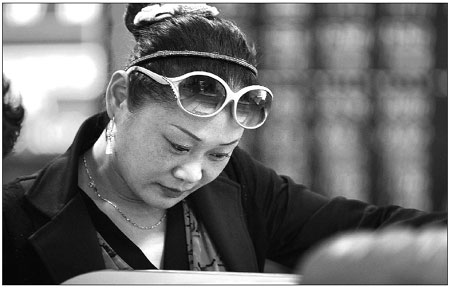

An investor watches share price movements at a brokerage in Huaibei, Anhui province. The Shanghai Composite Index declined 1.91 percent on Tuesday, the most since Feb 22. Woo He / for China Daily |

SHANGHAI - Stocks on the Chinese mainland fell the most in two months on concern that a faster inflation will spur the government to keep tightening and the recovery in the global economy may slow.

Jiangxi Copper Company Ltd dropped 3.41 percent after copper prices slid for a sixth day in New York. China Vanke Co Ltd paced losses for developers after Credit Suisse Group AG said the government may boost measures to curb property investment.

"The US credit outlook cut will have short-term negative effect on investors' confidence," said Mei Luwu, a Shenzhen-based fund manager at Lion Fund Management Co Ltd, which oversees more than $7.8 billion. "The risks have been there and the market is plunging now that they are exposed."

The Shanghai Composite Index declined 1.91 percent to 2999.04 at the 3 pm close on Tuesday, the most since Feb 22. The CSI 300 Index dropped 1.89 percent to 3295.81.

Jiangxi Copper slid for a seventh day, losing 3.41 percent to 37.71 yuan ($5.77). Yunnan Copper Industry Group Co Ltd fell 3.46 percent to 25.09 yuan. PetroChina Ltd slipped 2.06 percent to 11.86 yuan.

Consumer prices rose 5.4 percent in March, according to figures released by the National Bureau of Statistics. That exceeded the median forecast in Bloomberg News surveys of economists for 5.2 percent.

"We expect to see fluctuations around 3000 for the index as the March inflation data boosted concerns over tightening measures," said Mei.

The People's Bank of China may raise interest rates twice more in the next 12 months as capital inflows complicate efforts to tame inflation. Two-year contracts indicate the one-year deposit rate will be boosted 58 basis points in the next 12 months to 3.83 percent after four increases the past year, data compiled by Bloomberg show.

Barton Biggs, a former chairman of Morgan Stanley Asset Management, said the move by China's central bank, which indicates the country is going to do whatever it takes to cool inflation, makes him nervous about his bullish position on Asia and global equities.

For the first time in two years, emerging-market analysts are cutting profit estimates more than they're raising them, consumer stocks are trailing energy producers and shares of smaller companies are losing to larger equities, data compiled by Bloomberg and Morgan Stanley show.

Lion Fund's Mei is cautious on small-cap food producers and healthcare companies, while favoring banks, developers, coal producers and chemical companies.

"Overall, we are positive on the A-share market for the second quarter given the undeterred economic growth," Mei said. "Valuations and the earnings outlook make some A-share companies very attractive to global investments."

Bloomberg News

(China Daily 04/20/2011 page16)