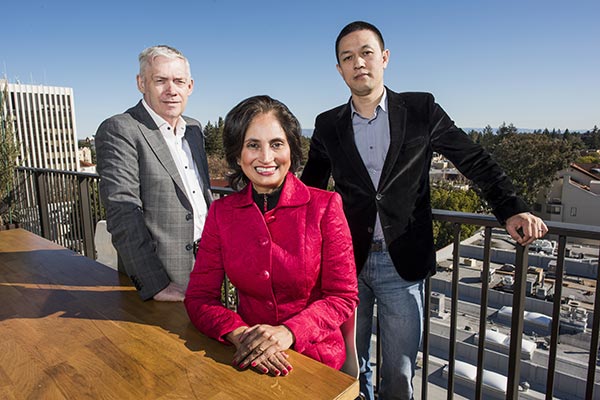

Martin Leach, president of NextEV Inc, Padmasree Warrior, chief executive officer of US operations for NextEV, and William Li, executive chairman of NextEV, stand for a photograph.[Photo/Agencies]

NextEV rethinks the electric car as more of a digital platform than a transportation vehicle

William Li isn't your typical, boundlessly optimistic Chinese tech entrepreneur. Yes, the founder of startup NextEV Inc has big plans to disrupt China's electric-car market and the financial backing of venture capital powerhouses Sequoia Capital and Hillhouse Capital, and considers Tesla Motors Inc founder Elon Musk an inspiration.

That said, he rates his chance of succeeding in China's fast-moving car market at a whopping 5 percent. He also thinks most of the new business models for electric cars being bandied about by tech companies will end up in the junk yard.

"There's an exponential gulf between creating a concept car and mass production, and then to actually sell them," Li said. "Tesla has broken a lot of new ground and inspired a raft of internet companies to follow, but most have no idea what they're facing."

Such hard-nosed realism is probably wise. As global auto executives gather for the 2016 Beijing Auto Show, a torrent of money is pouring into the nation's alternative energy vehicle market, which includes electric vehicles, plug-in hybrids and fuel-cell cars. In a country with a rapidly urbanizing populace, the market's upside potential seems big to conventional car companies and tech startups jumping in.

The Chinese government is promoting what it considers a strategic industry with big subsidies for companies and consumers. It wants new-energy vehicle sales to top 3 million units a year by 2025, versus 330,000 in 2015. Premier Li Keqiang in February urged local government and industry players to speed up construction of charging facilities to accommodate 5 million electric vehicles by 2020.

Right now, the electric-car business is dominated by BYD Co, a Shenzhen-based automaker, 9 percent owned by Warren Buffett's Berkshire Hathaway Inc, that has an 18 percent share of China's new-energy vehicle market. At the Beijing show, BYD will be touting its new entry-level sport-utility vehicle called The Yuan, as in the 13th-century Chinese dynasty, that starts from 209,800 yuan ($32,360) for the hybrid version.

Tesla is a player, too, in China. It sells its Model S and Model X, though the Palo Alto, California-based electric-car maker would like to be a far bigger one. For the first three quarters of 2015, the company sold 3,025 vehicles in China, which compared to 11,477 units of delivery by BYD. The Chinese company also sells its electrics in the United States, Germany and Japan, and surpassed Tesla in May to become the world's biggest maker of new energy vehicles.

|

|

A NextEV racing car at the Formula E Championship race in Beijing in 2015.[Photo/Agencies] |

That could play to the strengths of technology companies. And the huge and growing Chinese auto market could be the perfect laboratory in which to experiment with new services and business models, according to Bill Russo, managing director at Shanghai-based auto consultant Gao Feng Advisory.

Russo compared today's autos to the mobile phones of a decade ago, when apps started to gain in popularity. "As cars become mobility service platforms, the technology on board will become more sophisticated," he said. Technology companies could contract out auto production to make vehicles, but then earn recurring revenue by providing car owners with data products and internet services. "Apple makes money not just on the device, but on all the services that flow through it," he said.

Several technology companies are already in the fray. Electronics contract manufacturer Foxconn Technology Group, internet service portal Tencent Holings Ltd and China Harmony New Energy Auto Ltd have set up a joint venture to build alternative energy cars. The partnership is designed to leverage different strengths: Foxconn's component supply chain, Tencent's infotainment and telematics systems that could improve vehicle's connectivity and Harmony Auto's after-sales network for electric vehicles. In January, Daniel Kirchert, head of Infiniti Motor Co in China, joined the alliance.

Chinese tech billionaire Jia Yueting also has automotive ambitions. The chairman and founder of LeEco Holdings Co, which makes web-enabled televisions and smartphones and offers cloud and e-commerce services, is a major investor in Los Angeles-based Faraday Future Inc, which is building a 900-acre factory near Las Vegas, Nevada. LeEco, which has developed its own electric vehicles, is preparing to apply for a production license in China and also plans to manufacture its cars overseas.

Given all the new entrants, it is easy to understand why NextEV founder Li is wary of the competition, even with financial backers like Sequoia. Li has hired former Cisco Systems Inc chief technology officer Padmasree Warrior to lead development and US operations, and has inked a deal to outsource production to Anhui Jianghuai Automobile Co.

"They're realistic, they're seasoned, smart people with a lot of money and they're unafraid of the challenge," Michael Dunne, head of strategy and investment advisory firm Dunne Automotive Ltd, said of NextEV. "In fact, they seem to be embracing it."

Li said NextEV is an opportunity to rethink the electric car as not just as a transportation vehicle but as a digital platform. "Traditional auto manufacturers treat the car as 95 percent transportation tool," Li said. "Tesla's cars have perhaps 20 to 30 percent content that are not related to transportation," he said, referring to such things as mobile connectivity and touch-screens that access car maintenance services. "My aim is to boost that to more than 50 percent."

NextEV has produced an electric Formula E series racer, but hasn't yet disclosed its plans for launching an electric car aimed at the consumer market.?