China's capacity-cut drive - successes and setbacks

BEIJING - Looking back at the economic priorities China set for 2016, addressing industrial overcapacity was always going to be a key battlefield.

The first stage in solving any problem is acknowledgement: China committed to addressing overcapacity in 2016, and while the government scored an initial win, there were a few setbacks and the battle is far from over.

For years, a wide range of industries in China, from steel, cement, aluminum and flat glass to coal, have been running at overcapacity.

The gluts have extensive implications: depressed commodity and materials prices, reduced profits of debt-ridden firms, increased non-performing loans that jeopardize financial stability.

Moreover, overcapacity weighs on innovation as there is no incentive for cash-strapped firms to upgrade, making China an easy target for international trade friction.

Over 2106, China has introduced policies on fiscal and tax support, the handling of non-performing assets, redundancy support, while encouraging mergers and acquisitions.

Steel and coal, the two most troubled sectors, were made priorities. In February, the government announced that steel capacity should be cut by between 100 and 150 million tons by 2020, 45 million tons of which should be achieved in 2016.

The coal capacity reduction was set at half a billion tons over the next few years, with 250 million tons expected for 2016.

Progress came faster than expected. In late November, the State Council announced that both targets for the year had been achieved ahead of schedule.

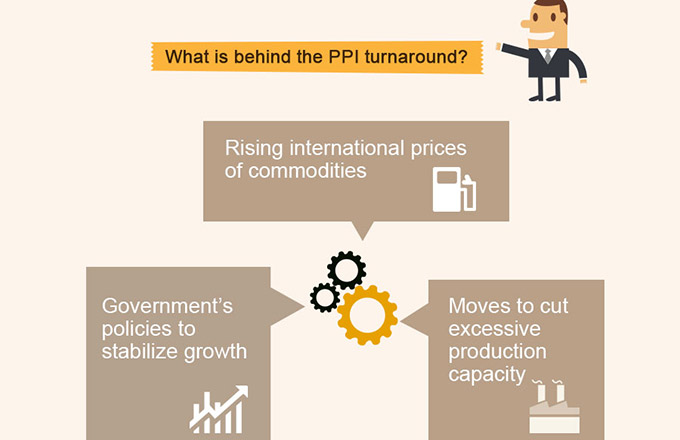

The most immediate effect of the drive was the recovery of commodity and material prices, with the producer price index, measuring costs at the factory gates, entering positive territory in September for the first time in nearly five years.

Last month, the index rose 3.3 percent, a level not seen since late 2011.

"This shows easing of unequal industrial supply-demand," said Wang Xiaoguang of the China Academy of Governance.

Thanks in part to this success, China's broader economic growth is showing increasing signs of stabilizing, with indicators such as profits and production all on the up.

Analysts agree that the results have not come easy, but the lessons learned will be invaluable to going forward.

More than halfway through the year, most regions reported that they had hit a wall and progress had slowed, much to the ire of policymakers.

Then progress suddenly accelerated, resulting in a supply crunch and driving unexpected price rallies, forcing policymakers to ensure supply, rather than hold it back.

The Bohai-Rim Steam-Coal Price Index, a gauge of coal prices in northern China's major ports, at one point exceeded 600 yuan ($87) per tonne,a more than 60 percent increase from the start of the year.

From glut to dearth, the sharp turn of events saw some economists questioning whether policy-driven capacity reductions, despite the short-term miraculous effects, would work in the long run.

For one thing, the government, unlike the market, is incapable of evaluating the "quality" of business capacity, which could result in the wrong companies being forced to close.

Bowing to government pressure, some firms could just halt production temporarily to meet their assigned tasks, instead of seriously eliminating capacity. Reports of unofficial production in steel and coal have already emerged due to the recent price rallies.

According to Wang,the government must allow the market more say, with the responsibilities of the government and the market more clearly delineated.

For Lian Weiliang, deputy head of the National Development and Reform Commission, "China's chronic overcapacity shows that simply relying on the market will not solve the problem."

The overcapacity issue has been a long time in the making. State-owned firms, which dominate most heavy industries, have a reputation for being insensitive to market demand.

China's fiscal expansion since 2008, initiated to combat the global financial crisis, was taken by many local governments as an excuse to blindly over-invest, resulting in a surplus of goods that the post-crisis world neither wanted nor needed.

Capacity cuts also mean that less taxes are collected by local authorities and bring job losses across the board. Without the intervention of the central authorities, local authorities would be very reluctant to do what is need, according to Liang.

To strike a balance, Wang suggests the market should be responsible for the first round of reductions, while the government should handle the reemployment of redundant workers.

It has been forecast that the coal and steel sectors will reduce their workforce by 1.8 million. In May, the Ministry of Finance announced a fund of 100 billion yuan for companies in the sectors to support workers after redundancy.

Wang forecasts that capacity-cuts will take three to five years before they can be deemed a success. "As long as the pace is controlled, the drive will support China's development and make a greater contribution to worldwide growth," he said.