The country's first private-run bank -- China Minsheng Bank -- was founded in 1996 in Beijing and has since made its reputation through lending to small and medium enterprises (SMEs). The new contenders approved last week are also expected to broaden SMEs access to banking credit.

SMEs contribute more than 60 percent of gross domestic product (GDP) and provide more than 80 percent of urban employment but they are underserved in the banking system.

State-owned lenders are more willing to lend to large firms and State-owned enterprises (SOEs), or entities with an implicit guarantee of a government bailout should they default.

|

|

To survive, private-run banks have a lot challenges to overcome. New lenders are not rivals to established, State-backed lenders in the scramble for bank deposits, though wealth management products marketed by Internet firms have been slowly chipping away at State-owned banks' deposit base, Lian said.

Given the difference between large banks and these newcomers, the banking regulator should draft tailored policies to regulate private banks, according to Taizhou Bank's chairman Chen.

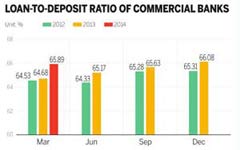

In China, banks' lending activities are restricted by rules such as asking them to park more than 20 percent of their deposit at the country's central bank and to lend no more than 75 percent of their deposit.

Authorities are also working to put in place a system to insure deposits against bank failures. Chinese Premier Li Keqiang said during the country's annual parliamentary session in March that the country would roll out the program this year.

This arrangement is deemed as a crucial step in the reform to liberalize interest rates in the banking sector. The central bank removed the floor of renminbi loan rates last July and asked nine leading domestic banks four months later to report daily the rate they charge their best clients to reflect market rates for loans.

The central bank still sets deposit rates and allow banks to offer returns to depositors at 1.1 times the benchmark rate. Analysts say the cap will be removed only after banks are covered by deposit insurance.