China's stabilizing influence

Stock markets in China have had a reasonably good performance in recent weeks thanks to somewhat positive economic data that suggests a change from the slowdown in growth that has characterized the economy over the last three-and-a-half years.

New numbers on industrial production and services suggest China's economy may be entering a phase of moderate but steady growth after slowing down during 12 of the last 14 quarters.

"There seems to have been a turnaround in economic activity since the financial volatility in June," says Alaistair Chan, an economist at Moody's Analytics. "The July data were quite strong and we expect that the momentum carried into August."

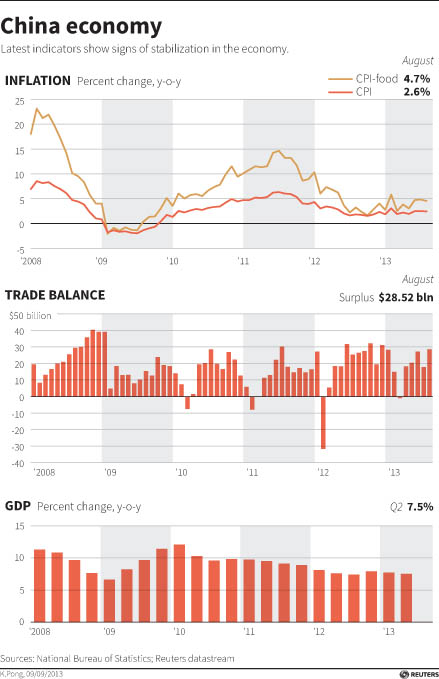

"The government has been doing some mini-stimulus, but ultimately I think the economy was not slowing down as much as it seemed to observers back in June," he adds. "Our forecast is for growth this year to be close to the government's 7.5 percent target."

China's official Purchasing Managers' Index (PMI) figure, issued by the National Bureau of Statistics and the China Federation of Logistics and Purchasing, jumped to 51 in August from 50.3 in July, well ahead of the 50.6 consensus forecast.

Much of the rise was driven by new export orders, with the sub-index rising to 52.4 in August from 50.6 in July. New orders also expanded to 50.2, up from 49. The HSBC flash PMI also rose to 50.1 in August from 47.7 in July.

The non-manufacturing PMI dipped slightly to 53.9 from 54.1 in July, but services hit a five-month high in August.

The Markit/HSBC Services PMI, released on Sept 4, came in at 52.8 in August, up from 51.3 in July and the highest level since March.

In both cases, figures above 50 signal expansion.

"The rise in new orders set a good foundation for growth in the next few months," said Cai Jin, deputy head of the China Federation of Logistics & Purchasing in a statement.

Many economists were quick to revise their growth forecasts for the second half of the year to as high as 7.7 percent.

The new optimism was widespread but not unanimous.

"It is worth noting that this bounce is occurring within a broad structural downtrend in the survey numbers," says Rahul Ghosh, head of Asia research at Business Monitor International (BMI).

"Absent a major credit injection and aggressive stimulus plan - both of which appear unlikely - the bounce in manufacturing may prove difficult to sustain," he says.

Still, limited attempts to stimulate the economy are likely to keep growth levels for the rest of the year, says Ghosh. BMI expects full year growth of 7.5 percent.

Interestingly, the return to stronger growth may be driven by domestic consumption and by larger enterprises that were in a better position to overcome a liquidity squeeze in June, said Ting Lu, chief China economist at Bank of America Merrill Lynch, in a note.