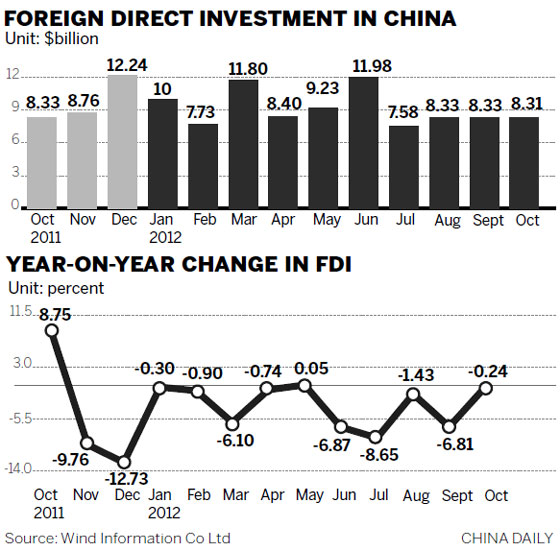

Investment from overseas falls for 11th month in the past year

In October, foreign direct investment going into China showed its 11th monthly drop in the past year.

The decline came amid global economic troubles and a deceleration in China's own economic growth, both of which have made investors more hesitant to spend money.

|

|

|

A Coca Cola bottling line in Zhengzhou, Henan province. Foreign direct investment in China declined for the 11th month in October over the past 12 months as China's economic slowdown dented global investors' confidence. [Photo/China Daily] |

Shen Danyang, Commerce Ministry spokesman, described the decline at a news conference on Tuesday as being temporary, saying it is related in part to changes in the types of FDI allowed into the country.

In October, FDI into China went down by 0.24 percent year-on-year, hitting $8.31 billion. That was the 11th drop in the past year. The only exception to that trend came in May, when FDI increased by 0.05 percent, the ministry said.

In the first 10 months of the year, FDI in China declined by 3.45 percent year-on-year to $91.74 billion.

"The successive deceleration seen in FDI into China stems mainly from the world's economic troubles, which struck global trade and investment at a time when China's economic growth was under pressure, despite the signs that the world's second-largest economy is moving out of its growth slowdown," said Huo Jianguo, president of the Chinese Academy of International Trade and Economic Cooperation, a ministry think tank.

Shen said he remains optimistic about FDI in China.

"It will keep up its momentum, particularly as the current deceleration stems from the country's restructuring of its FDI inflows," he said.

Huo agreed, saying that "FDI in China will see a slight gain in 2013 as the government stokes domestic demand and enlivens domestic investment conditions.

"But the world's economic troubles will prevent FDI from increasing quickly."

The first 10 months of this year saw the European Union's investments into China decrease by 5 percent from a year earlier, hitting $5.24 billion.

During the same period, US investments in China reversed their declining trend, going up 5.3 percent year-on-year. With October excluded from the calculation, US investments showed a 0.63 percent decline year-on-year.

Japanese investments in China increased by 10.9 percent year-on-year from January to October, hitting $6.08 billion. With October excluded, the increase was 17 percent year-on-year.

Those investments come amid a dispute over Japan's illegal purchase of China's Diaoyu Islands. If October is considered by itself, Japanese spending in China slumped by 32.4 percent year-on-year as Japanese companies became "more prudent on shifting their manufacturing bases to China", the Nikkei newspaper reported on Tuesday.

The dispute between China and Japan has affected the countries' trade as well as their investments into each other's markets.

The seventh East Asia Summit, held in Cambodia from Monday to Tuesday, was not an occasion for scheduled talks between Premier Wen Jiabao and Japanese Prime Minister Yoshihiko Noda. Even so, ministerial-level talks among China, Japan and South Korea led to a trilateral free trade agreement, that will help further integrate the region's trade and economy.

Gui Haoming, chief analyst at Shenyin & Wanguo Securities Co, said FDI will continue to go into China at a slower pace so long as the global economy shows signs of a meek recovery and China's economic growth slows.

The Global Investment Trends Monitor, released by the United Nations Conference on Trade and Development on Oct 23, showed that China attracted $59.1 billion worth of FDI in the first half of the year, surpassing the US to become the recipient of the largest amount of foreign direct investment. Many saw that as a sign that global investors are still confident in China's economic prospects.

In contrast to the decrease in FDI, China's outbound direct investment kept up its momentum from January to October, increasing by 25.8 percent year-on-year to $58.17 billion.

"This is the inevitable outcome of Chinese companies' going abroad, of an improvement in Chinese companies' competitive strengths," Shen said.

China will find it hard to have its foreign trade increase by 10 percent this year, a figure called for by government plans.

Even so, its share in global trade "is likely to keep expanding this year from 10.4 percent in 2011, as China's foreign trade increased faster than other major economies' and also faster than global trade expansion", Shen said.

lijiabao@chinadaily.com.cn