Nation to feature strongly in planned $16b investment, says mining chief

The chief executive of Rio Tinto Plc, the world's third-largest miner by market capitalization, is confident of continued economic growth in China, and says his company is planning further expansion worldwide, in anticipation of a recovery of the steel market in the country.

Tom Albanese told China Daily in Beijing on Friday that despite imported iron ore prices falling dramatically in recent months, China will feature strongly within a planned global investment of $16 billion by his company in its mining businesses.

|

|

He said the investment will be used in sectors including iron ore, copper, coal and aluminum businesses, in order to meet growing demand from China.

Albanese said he estimates China's steel output will increase by up to 40 percent from now to 1 billion metric tons by 2030.

"The figure matches the Chinese government's development plan," he said. "China's economy needs to balance its growth and sustainability, which is very important to match Rio Tinto's strategy."

However, the head of the world's second-largest iron-ore producer by output after Brazil's Vale SA also warned that he considered China's economic development in the past decade as too fast and unsustainable, and said that he hoped it would be slower and more sustainable during the next 10 years.

The international price of iron ore has been falling since August because of less demand from steel producers in China.

Because of the better quality and cheaper price of imported iron ore, China's domestic steel mills are buying more imported iron ore, which has led to the increasing imports with lower prices.

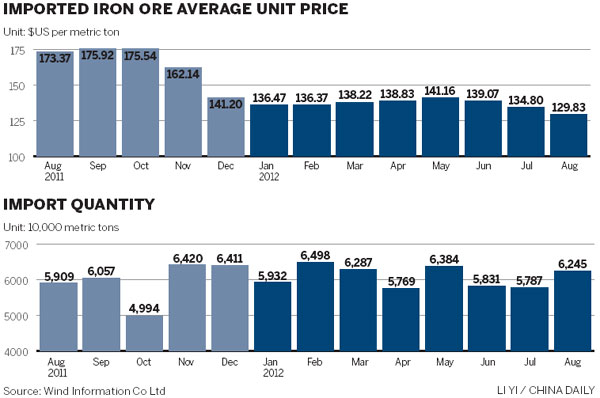

According to the latest industry figures from the customs office, China's iron ore imports in August reached 62.45 million tons, a 7.91 percent increase compared with the previous month.

But the average imported iron ore prices dropped to $129.83 a ton, a 3.69 percent reduction month-on-month, a record low since June 2010.

The price of ore with 62 percent iron content delivered to China has dropped to $90 a ton by the end of the last week, down 50 percent compared with the highest price level last year.

China imported 486 million tons of iron ore during the first eight months, an 8.7 percent growth year-on-year with a 16.48 percent drop in the average price.

In the first half, Rio Tinto's basic earnings dropped 34 percent to $520 million with revenue of 25.34 billion yuan.

However, Albanese said the diversified mining group still has the lowest costs compared to other miners, so it can still maintain its profitability during the industry downturn.

He said the company plans to increase its annual output to 283 million tons from its mines in Pilbara region of Western Australia by the second half in 2012, and to 350 million tons by 2015.

At present, iron ore output in the region is 230 million tons.

Meanwhile, the company's Simandou iron ore project in Guinea - run in cooperation with the Aluminum Corporation of China - the country's top aluminum producer - is at the exploration stage, said Albanese. He expects the project to start production in 2015.

"The Chinese central government has carried out a series of policies to stimulate the economy, which we believe will lead to a gradual improvement in iron ore demand," he said. "We are betting on the next round of the growth cycle."

dujuan@chinadaily.com.cn