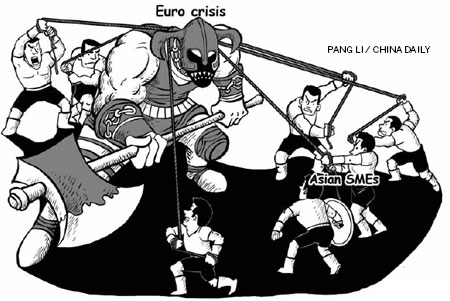

Asia's small and medium-sized enterprises (SMEs) are thriving, benefiting from strong economic growth throughout the region. But in an increasingly interconnected world, they are not immune to problems elsewhere, such as the euro crisis.

Even for SMEs not directly exposed to European trade flows and/or currencies, there could be bottom line implications. The uncertain outcome of the crisis could lead to increased volatility in foreign exchange and commodity prices, both of which could have a great impact on SMEs engaged in trade and manufacturing. Given these risks, it is important for all SMEs to have sufficient liquidity, including access to debt, to ensure business continuity in their operations.

SMEs are often an integral part of the supply chain of multinational companies (MNCs). For larger medium-sized enterprises, they may supply to or buy direct from the MNCs and for smaller businesses. They may also deal directly or through other companies, including other SMEs. If an MNC is headquartered or based in Europe, then all SMEs in its supply chain are likely to feel the impact of the debt crisis.

The challenge is that MNCs literally "anchor" the chain and often dictate buying and selling terms. During lean times, MNCs will need to balance their own survival and shareholder expectations with the longer-term objective of creating a sustainable and reliable supply chain.

It is no surprise then that some MNCs would need to shorten the credit terms extended to SME buyers and lengthen payment periods to SME suppliers (or perhaps completely cancel orders) to reduce their own working capital requirements in the short term. The downstream knock-on effect is clear when considering the significant reliance that SMEs have on their relationships with MNCs - many SMEs would rather end up absorbing the working capital impact than ending the erstwhile valuable relationship.

The irony is that SMEs are in an inferior position to absorb these downstream macro effects and this consequently has a number of implications for them:

Reduced credit appetite from their banks because of their European exposure (in complete contrast to the generally positive impact this has on SMEs during better times);

Increased working capital requirements relative to the proportion of the impact they in turn can pass on to their customers;

Managing the time between the impact of the changes and passing them on;

Reduced bank and country risk limits and/or increased pricing on solutions or products incorporating these as risk mitigants;

Increased currency volatility that they may not be resourced for or experienced enough to deal with;

New or additional currency hedging costs;

Credit insurance costs on counterparties not considered as a default risk before;

Possibility of price increases for SME buyers or price reductions for SME suppliers to MNCs;

And need to consider diversifying their reliance on a particular MNC or country, but it is not a simple process to replicate a track record and long relationship.

It is difficult for SMEs to completely stop one MNC relationship and start another. It requires overlap and additional resources and time to pursue the new partnership while still relying on the existing, possibly strained, relationship.

Asian SMEs should assess their foreign exchange (FX), interest rate and commodity exposures and review the different options available in mitigating these risks. These can be in the form of FX forwards, interest rate/currency swaps, vanilla options or commodity hedging solutions. With the help of treasury specialists, SMEs can mitigate some of these uncertainties in their operating costs.

SMEs should also analyze their ongoing business exposures to clients, in particular, those that are in or are dealing with Europe. Credit risk on receivable counterparties can be mitigated by taking appropriate insurance, and working capital lines to support any lengthening of payment terms should be secured before rather than after the company has a cash crunch. Businesses often fail because of cash shortages and not because they are not profitable.

Surplus cash-flow can also be invested in less risky high investment grade bonds and/or principal-protected deposits. SMEs that are concerned about maintaining cash-flow liquidity can also opt for loan-to-value investments, which allow them the option of drawing on the value of their yield enhancing investments should the requirement arise.

There are different opinions on the ultimate outcome of the euro crisis and the extent to which it may affect businesses in Asia. However, there is no doubt that SMEs should be prepared and plan ahead, taking measured actions to ensure their continued survival.

The author is global head of SME Banking, Standard Chartered Bank.