Data from People's Bank of China shows slump in lending in July

Sharply slowing export growth together with a slump in bank loans and industrial output in July are pointing to a prolonged slowdown for the world's second largest economy.

China's exports increased 1 percent year-on-year in July, the worst growth since 2009, reflecting how the global economic slowdown has weakened demand for Chinese exports, the General Administration of Customs said Friday.

Meanwhile, data from the People's Bank of China, the central bank, showed that China's bank lending slumped 41.3 percent in July from the previous month, the lowest monthly figure since September 2011.

Chinese banks extended 540.1 billion yuan ($84.9 billion) in new loans in July, compared with 919.8 billion yuan in June, the bank said.

The set of poor macroeconomic data put more pressure on the government to loosen policies, said Zhang Zhiwei, an economist with Nomura.

China's foreign trade increased by 2.7 percent from a year earlier in July. Exports edged up by 1 percent year-on-year while imports grew by 4.7 percent, yielding a trade surplus of $25.15 billion. The first seven months saw China's trade rise by 7.1 percent from a year earlier, according to customs.

"The sluggish demand in the EU market, caused by the deepening debt crisis in the bloc, was responsible for China's slowed trade growth in the first half of this year," Gao Hucheng, vice-minister of commerce, said at a press briefing of the Ninth China-ASEAN Expo and the Ninth China-ASEAN Business and Investment Summit held in Beijing on Friday.

"Amid the spreading global debt crisis and the slowdown of China's economic growth, the country's foreign trade will face more pressure and a more challenging outlook in the second half of this year. And there is certain pressure in achieving the goal of 10 percent trade growth this year," Gao said.

Zhang from Nomura said that export growth will likely be weak in the coming months as well.

Trade: Government emphasizes stability

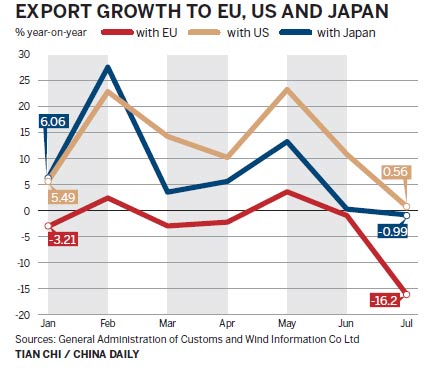

China's exports to the EU dropped by 16.2 percent in July from a year earlier. And exports to the US edged up by 0.56 percent year-on-year in July. The US replaced the EU in the first half of this year as China's biggest export market.

China's foreign trade figures come hot after the release of a flurry of other economic data including industrial output growth and new yuan lending.

Growth of industrial output, the key monthly measure of China's economic health, dipped to 9.2 percent year-on-year in July, down from 9.5 percent in June and the lowest level since May 2009, the National Bureau of Statistics said on Thursday.

Electricity generation eked out a 2.1-percent year-on-year increase, suggesting a sharper slowdown in energy-intensive heavy industry.

"With the current situation, we have almost eliminated an economic growth rebound in the third quarter. The fourth quarter will probably see a reverse of China's economic slowdown and the whole year GDP expansion will be around 8 percent," said Li Xunlei, deputy CEO and chief economist from Haitong Securities in Shanghai

China's GDP grew by 7.6 percent in the second quarter compared with a year earlier, down from 8.1 percent in the first quarter and the slowest pace since the second quarter of 2009.

The government has taken the rare step of slashing interest rates twice in quick succession this year, while also lowering requirements for how much money banks must keep in reserve, as it looks to spur lending and boost growth.

"As the government further emphasizes stabilizing economic growth, it's likely to see more easing monetary policies in the rest of this year," said Jia Kang, president of the Institute of Fiscal Science at the Ministry of Finance.

Jia added that the economic slowdown will reach bottom in the third quarter and bound up in the fourth quarter.

The consumer price index, a main gauge of inflation, slowed to 1.8 percent year-on-year in July from 2.2 percent in June, the lowest level since January 2010. That opens up space for the government to take more monetary measures to support growth.

More confidence

"However, we still have confidence in the future of foreign trade as many enterprises have done a very good job in transforming and upgrading. Many enterprises have been putting more effort into research, development and innovation since 2008," Gao said.

"As the EU is haunted by the debt crisis, emerging markets are becoming more important to China's foreign trade. China's trade with ASEAN countries will keep growing rapidly in the second half of this year after bilateral trade increased by 9.8 percent year-on-year in the first half."

Li said that China will face more difficulties in exploring emerging markets as economic growth slowed in emerging economies.

"Orders have shrunk by 20 to 25 percent year-on-year," said Sun Yingli, general manager of Shanghai Manlang Textile Company, a garment manufacturer relying mainly on orders from Europe and Japan.

"I reckon it will be harder next year," she said, as she believes the European market won't recover soon, while Japanese authorities are subsidizing garment products imported from Southeast Asia.

Wang Weiyi, vice-president of tool manufacturer GreatStar, said orders grew by 8 percent last year, with larger demand coming from the US market.

Contact the writer at lijiabao@chinadaily.com.cn

Washington to remain focused on Asia-Pacific

Washington to remain focused on Asia-Pacific RQFII target blue chips amid bear market

RQFII target blue chips amid bear market Australian recall for top two exporters

Australian recall for top two exporters China fears new car restrictions

China fears new car restrictions