China's outbound direct investment surged in the first half of this year as growing numbers of domestic enterprises go global to secure talent and technology.

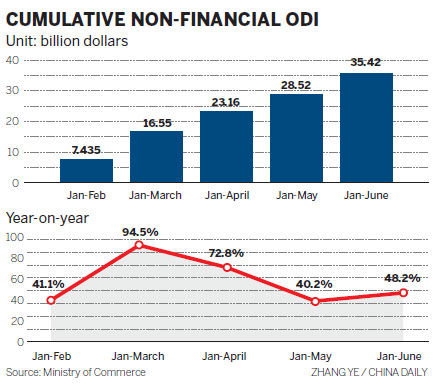

Chinese non-financial ODI increased 48.2 percent year-on-year to $35.42 billion in the first half of this year, according to the Ministry of Commerce. One-third of the ODI, or $11.8 billion, was carried out through mergers or acquisitions.

China's ODI stood at $65.1 billion in 2011, down 5 percent year-on-year, according to the World Investment Report 2012 from the United Nations Conference on Trade and Development.

"China's ODI will maintain a relatively fast growth in the coming three to five years," said Zhuang Rui, deputy dean of the Institute of International Economy at the University of International Business and Economics in Beijing.

The central government started to encourage Chinese businesses to invest overseas in the 1990s, said Zhuang.

"After decades of development, Chinese enterprises have entered a phase of fast growth in overseas investment, which shows their deep involvement in globalization," said Zhang Yansheng, secretary-general of the academic committee of the National Development and Reform Commission.

Figures show ODI from the mainland to Hong Kong in the first half of 2012 surged 58.9 percent year-on-year. And ODI to the United States increased 28.2 percent year-on-year in the first half, while ODI to Russia expanded 20.3 percent year-on-year in the same period.

"Investment in Hong Kong is to acquire local talents or to use it as a springboard to invest in other regions," said Zhang.

"Investment in Russia and Brazil is to get energy and mineral products, while the investments in the US and the European Union gains access to talents and technology," he added.

"The increase means more private enterprises are involved in overseas investment. This is a very important structural improvement in China's ODI. In the past years, China's ODI was dominated by mergers and acquisitions by large State-owned enterprises to get resources, but ODI by private enterprises reflects the real competitiveness of China," said Ge Shunqi, a professor from the Institute of International Economics at Nankai University in Tianjin.

"But the real purpose for businesses to go abroad is to build up global business networks, and the increased participation of private business in this process will expand the country's ODI in a sustainable way," Ge added.

The ODI surge in the first half of this year was mainly due to China's strategy of encouraging enterprises to go overseas and tap international markets, said Ministry of Commerce spokesman Shen Danyang at a news briefing on Tuesday.

"The economic situation at home and abroad offers favorable opportunities for Chinese businesses to carry out overseas investment."

Ge added: "The global economy is struggling to recover, which forced major economies to attract investment, especially Chinese investment, to boost employment and growth."

Zhuang from the University of International Business and Economics added that avoiding trade friction amid the world economic slowdown is another reason for Chinese enterprises' overseas investment.

China was the subject of 40 potential trade disputes in the first half of this year, involving export of $3.7 billion, up by 76 percent from last year.

lijiabao@chinadaily.com.cn

Washington to remain focused on Asia-Pacific

Washington to remain focused on Asia-Pacific RQFII target blue chips amid bear market

RQFII target blue chips amid bear market Australian recall for top two exporters

Australian recall for top two exporters China fears new car restrictions

China fears new car restrictions