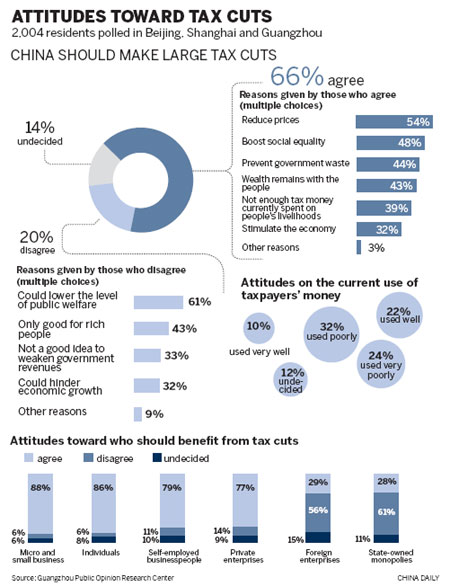

Relatively low government spending on public well-being in the current system and a stimulus for the economy were also cited as reasons for a tax cut in a survey of 2,004 people by the Guangzhou Public Opinion Research Center in June.

The survey reflects building public support for tax reductions after a rapid growth in tax revenue in China in recent years, which has been much higher than GDP growth.

Li Jian'ge, a member of the Chinese People's Political Consultative Conference National Committee and chairman of China International Capital, said in March a large-scale reduction of taxes was urgent and workable.

"If we could bring down the growth rate for fiscal revenue to within 10 percent this year, we would save businesses and residents at least 1 trillion yuan ($157 billion)," Li said during the annual full session of CPPCC National Committee.

One in five respondents to the survey are against large-scale tax cuts, saying such a move would lower public welfare, slow the economy and only help the rich.

The majority of those surveyed said tax cuts should be applied to small and micro enterprises, individuals, domestic non-State-owned enterprises and self-employed businesspeople.

Less than 30 percent think foreign companies and State-owned enterprises in a monopoly position should enjoy tax cuts.

The survey found 56 percent of people thought the taxation principle of "coming from people and used for the people" is not being well-applied, but 32 percent held a more favorable view.

Washington to remain focused on Asia-Pacific

Washington to remain focused on Asia-Pacific RQFII target blue chips amid bear market

RQFII target blue chips amid bear market Australian recall for top two exporters

Australian recall for top two exporters China fears new car restrictions

China fears new car restrictions