Case made to welcome Chinese solar products

Instead of doubling tariffs on Chinese solar products, the United States should embrace their affordability, according to one expert.

David Fickling, a columnist for Bloomberg Opinion who covers climate change and clean energy, wrote on Wednesday: "We are still not building enough solar and wind farms, nor enough factories for the components they'll use, to make the switch work. Yet President Joe Biden's justification for doubling tariffs on imported solar to 50 percent is that, to the contrary, the world has too many production lines for green tech."

In the article, Fickling noted that Chinese industrial policy caused the price of solar panels to fall from about 90 cents per watt in early 2012 to just over 10 cents per watt now.

"We should welcome that. Reducing the cost of green power is the single best thing the world can do if we're to escape catastrophic warming in our lifetimes," Fickling wrote.

Biden contended last month that the low cost of China's solar panels are a result of "policy-driven overcapacity" in manufacturing, "flooding global markets with artificially cheap solar modules and panels".

The White House announced on May 14 that tariffs on solar cells and modules will increase from 25 percent to 50 percent in 2024.

Fickling said that Chinese clean technology isn't "artificially cheap"; it's just cheap.

In an appearance on Bloomberg: The China Show on Thursday, Fickling said that "we're (the US is) still well below the capacity we need".

"The amount of renewables waiting to get connected to the US grid is greater than the amount of generating capacity on the US grid as a whole at the moment. So there are these huge bottlenecks." He said "a lot" of it has to do with permitting and grid access, and some of it has to do with finance.

But Fickling said, "You can't ignore the tariffs issue. It's clearly something that's not going to change. It's an election year issue. It's not going to change imminently."

He said that the United States has installed about one-tenth of the renewable power that China has installed.

Fickling said that "it needs to really increase that rapidly" to achieve 2035 net zero emissions.

Biden said he put the tariffs in place to protect the American solar industry and companies.

But Fickling said that all production lines are going to be needed if the US is to meet the target of decarbonizing its electricity grid by 2035.

He cited September's Group of 20 meeting, which called for a tripling of renewable power globally by 2030.

Fickling argued that by the end of this decade, the power grid will require about twice as many gigawatts of generators connected to it "as the current one we've spent more than a century building, and all of the net increase has to come from clean power".

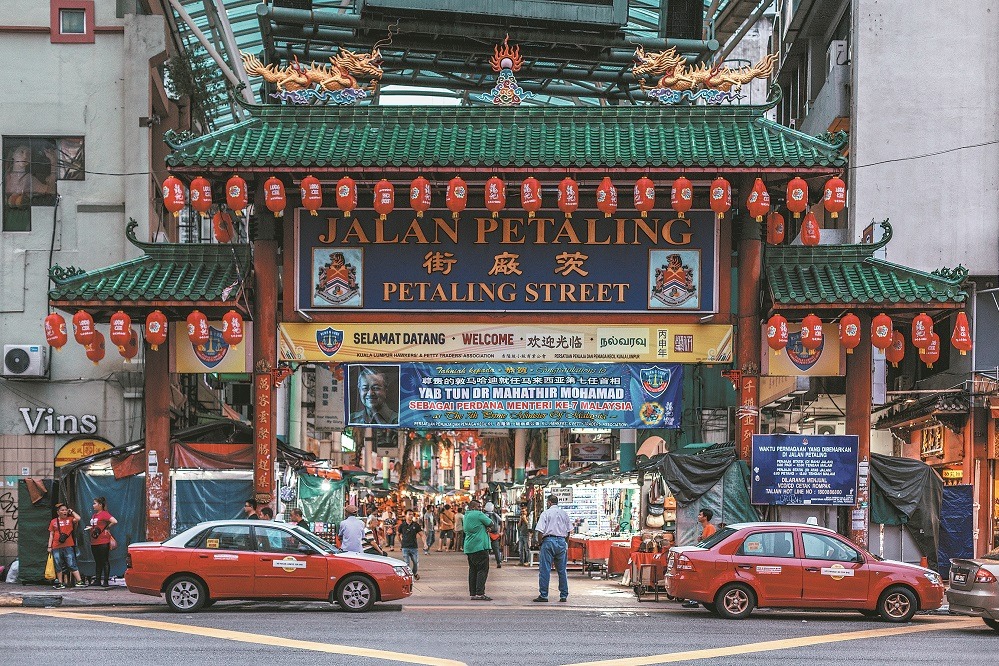

A two-year US moratorium on tariffs on solar products from Cambodia, Malaysia, Thailand and Vietnam expired on Thursday.

A report released Thursday by the International Energy Agency (IEA) found that China installed almost 350 gigawatts (GW) of new renewable capacity in 2023, more than half the global total, and if it maintains that pace, it will likely exceed its 2030 target this year.

Global investment in clean energy technology and infrastructure is set to hit $2 trillion this year, the IEA's World Energy Investment report said. Total energy investment is expected to exceed $3 trillion for the first time in 2024.

"For every dollar going to fossil fuels today, almost two dollars are invested in clean energy," said IEA Executive Director Fatih Birol.

China is set to account for the largest share of clean energy investment in 2024, with an estimated $675 billion, while Europe will account for $370 billion and the United States $315 billion.

"The United States is now playing catch-up on a technology that has really matured in China, and it's going to be very difficult to recreate those supply chains in a short period of time at a low cost," Ilaria Mazzocco, a senior fellow at the Center for Strategic and International Studies, told Yahoo Finance. "It's entirely feasible, but it's going to be a long time horizon, and it's going to be far more costly."

The IEA report also cautioned that in 2024, the share of global clean energy investment in emerging markets and developing economies outside China is expected to remain around 15 percent of the total.

"Both in terms of volume and share, this is far below the amounts that are required to ensure full access to modern energy and to meet rising energy demand in a sustainable way, the report said.

Agencies contributed to this story.