US stagflation is a triple-whammy by the Fed, Biden administration and Big Defense

Stagflation is no longer just a US recession threat, but a global risk. It is the net effect of a triple-whammy that penalizes American welfare and global recovery, but it will not harm defense contractors' profit margins.

Recently, President Biden admitted that US inflation was stuck at "unacceptably high" levels after the annual rate in April soared to 8.3%. He blamed the Covid-19 pandemic and Russian President Putin for the US' price increases instead of his government spending.

After four years of Trump devastation, the Biden administration had an historical opportunity to reset economic policies by nullifying the self-defeating trade wars, and reset geopolitics by redirecting military spending to welfare. Instead, the White House missed both opportunities. The net effect is the worst inflation the US has seen in four decades along with the possibility that the Fed could quickly turn it into stagflation.

What went wrong?

The Fed's mistakes: From inflation to stagflation

Since the onset of the pandemic, the Fed has made two mistakes: First was ignoring the WHO's warnings about the international spread of the COVID-19. The Fed began to cut rates belatedly in March 2020. The Trump administration amplified the mistake by trying to protect US equity market at the expense of American people.

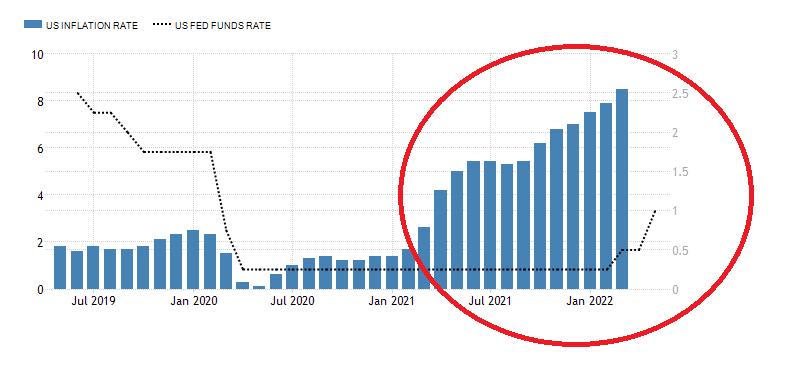

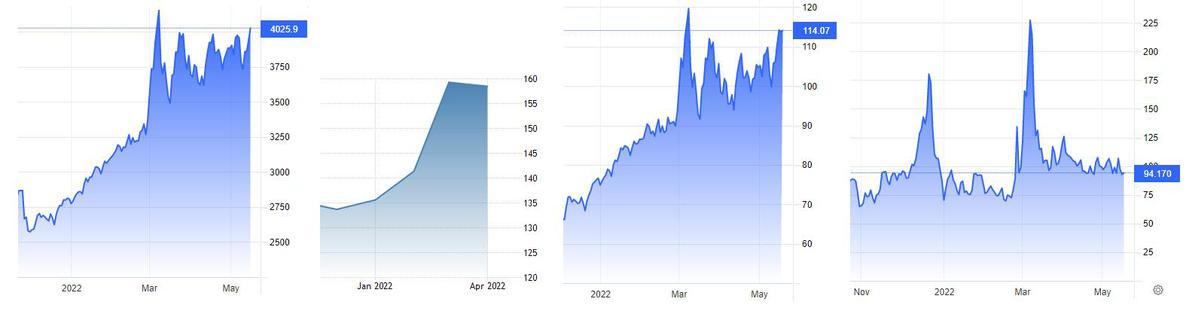

The second mistake ensued after mid-year of 2021, when inflation began to climb rapidly. Instead of a timely response, the Fed chairman Jerome Powell characterized rising prices as "transitionary." By December, inflation soared 7% from a year ago: and in March, 8.5%, a 41-year high. In early May, the Fed lifted its benchmark interest rate to a range of 0.75%-1%, after a smaller hike in March. It was the Fed's biggest increase in 22 years. In April, inflation slowed to 8.3%, but less than market forecasts.

How the Fed missed the leaping inflation.Source of the picture: Tradingeconomics; Difference Group, May 17, 2022.

Moreover, the Fed is planning quantitative tightening (QT) and will start culling assets from its $9 trillion balance sheet in June. It will do so at nearly twice the pace it did in its previous QT. Responding belatedly, it is overshooting. Hence, the concern with stagflation: rising prices coupled with economic stagnation.

The Biden administration's mistakes: Commodity and energy shocks

Commodities have soared 45 percent since the beginning of the year and remain close to the peak level. So do food prices, which climbed to an all-time high in March, up nearly 20 percent year-on-year in what UN Secretary-General Antonio Guterres called the "hurricane of hunger and a meltdown of the global food system."

Crude oil prices soared to a high of $125 in early March, increasing 43 percent since January, and it remains $113. In Europe, the most exposed region to Russian energy, natural gas price quintupled to a high of 230 euros and has dropped to 96 euros, as concerns over Russian supplies have dissipated somewhat, for now (Figure 2). Hence, the recession threat hanging over the Euro Area. And if the proxy war takes an adverse turn, the commodity and energy prices will soar again.

A benign scenario in the Ukrainian crisis would have required rapid, proactive diplomacy, but that hasn't been a priority in the proxy war. As US defense secretary Lloyd Austin acknowledged in late April: "We want to see Russia weakened."

Russia is the world's 11th largest economy at $1.8 trillion, the world's largest gas exporter and second-largest crude oil exporter. Neither the protracted Ukraine crisis nor the weaponization of sanctions will advance peace. But both will penalize global recovery.

As some US policymakers are calling for tariff reductions in order to provide relief to consumers struggling with soaring prices, the Biden administration is reviewing tariffs imposed on Chinese products ahead of their expiration in July. With the plunge of Biden's ratings, the Democrats are struggling to avoid a Republican triumph in the fall election.

Despite the hopes of the Trump and Biden administration, the US trade tariff wars have failed to reduce the deficit. Unilateral trade actions do not resolve multilateral trade challenges. In effect, the deficit widened sharply to a record high of $110 billion in March, due to a broad-based rise in prices.

Pentagon's mistakes: Big Defense over US national interest

The architect of US President Biden's geopolitics in Asia is Kurt Campbell, a veteran diplomat and CEO of the Asia Group LLC. In January 2021, his appointment unleashed a public debate in the US, due to Campbell's portfolio of ex-clients rife with potential conflicts of interests. According to his own disclosures, the key clients include leading defense contractors. As critics see it, "shadow lobbying" outfits, like Campbell's firm, call themselves consultants to avoid restrictions associated with traditional lobbying.

Campbell is not alone. Both secretary of state Antony Blinken and national security adviser Jake Sullivan were in similar firms resulting in similar debates. And before taking over the Pentagon, secretary of defense Lloyd Austin served on the board of Raytheon, a major defense contractor.

What makes Campbell different is that he predominates US policymaking in Asia. Moreover, in November 2021, Biden nominated Fed governor Lael Brainard to serve as its vice chair. With the confirmation of the appointment, her dovish views have shifted. She is pushing rapid rate hikes. Brainard is an accomplished veteran Democrat, like her husband – Kurt Campbell.

In addition to Campbell's alleged conflicts of interests, the husband-wife linkage reinforces critics' perceptions of tacit collusions in the decision-making by the executive branch, monetary chiefs, capital markets, Pentagon and the Big Defense.

Since the Obama administration, the White House has promoted a "pivot to Asia," a doctrine which is premised on US military might and is very much in line with the interests of the Big Defense. Its architect just happens to be Campbell as well.

Among other things, inflation has contributed to the excesses of US housing market, which keeps it out of reach for many ordinary Americans. By contrast, defense contractors are prime beneficiaries of inflation, due to the increased defense budgets, including the use of inflation as an excuse to price-gouge.

It is thus only prudent to wonder whether Campbell's pivot is less motivated by American welfare and US national interest than by the Pentagon's revolving-door practices and defense contractors' fat margins.

The author is the founder of Difference Group and has served at India, China and America Institute (US), Shanghai Institutes for International Studies (China) and the EU Center (Singapore).

The opinions expressed here are those of the writer and do not necessarily represent the views of China Daily and China Daily website.

If you have a specific expertise, or would like to share your thought about our stories, then send us your writings at opinion@chinadaily.com.cn, and comment@chinadaily.com.cn.